CRYPTOCURRENCY PORTFOLIO

.jpg)

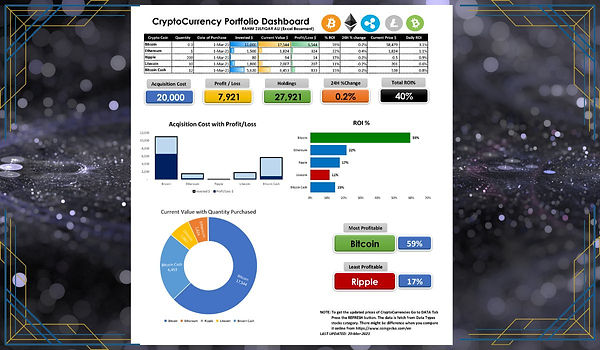

Here's how to build a cryptocurrency portfolio.

Investing in Cryptocurrencies strategically reduces the risks associated with them. Different digital properties have varying levels of threat in the Crypto space. We share 5 different cryptocurrencies and their risk levels in this short article, along with tips on how to build an appropriate portfolio.

The types of coins

Crypto portfolios assist you in managing your crypto investments online. Diversifying your portfolio will allow you to expand both your earnings and your crypto horizons.

When it comes to types of cryptocurrencies to include in your portfolio, there are a few to consider. Here's what they are and how to incorporate them into your portfolio.

Stablecoins

A stablecoin is a cryptocurrency whose value is tied to another asset, such as a fiat currency or gold. As a result of this connection, Stablecoins are much more stable and present the least amount of risk.

A threat reduction strategy involves avoiding the volatility of crypto markets while holding a digital asset. As with conventional checking accounts, these coins can also be staked to get a bigger annual reward.

Adding stablecoins to your portfolio will provide liquidity and might even reduce fees associated with fiat conversion. The disadvantage of stablecoins is that there is little chance of making significant returns. As a result, you must compromise high benefits to be at a lower risk.

Bitcoin

Bitcoin dominates the crypto world with over half of all capital. Comparing Bitcoin to other cryptocurrencies, it appears to be less dangerous due to its large market share.

Bitcoin is primarily used as a store of value. Numerous crypto financiers stocked Bitcoin as much as they could as a result. The market cap of Bitcoin is expected to surpass one trillion by the end of 2021, making it one of the best coins for long-term holdings.

When it comes to your portfolio, its volatility and unpredictability are essential elements. Current times have seen a big crash in the Bitcoin market, and its value has fallen along with it. Despite all this, many people still consider Bitcoin to be an excellent investment due to its dollar-cost averaging.

Altcoins

Altcoins are any cryptocurrency other than Bitcoin. In comparison to stablecoins and Bitcoins, these coins are more volatile. Higher volatility can indicate two things, greater earnings potential or greater losses potential.

A lower market cap and higher adoption rate help its upward price movement, while being less recognized increases its potential downward price movement. In the same way, altcoins vary in terms of risk and benefit. Make sure you do some research before including altcoins in your portfolio.

Meme Coins

An influencer's promotion and the rise of meme culture determine the value of a meme coin. One of the most popular cryptocurrencies on the market is Dogecoin, which is a meme coin.

Dogecoin's volatility and stability are extremely fragile and can change rapidly. Before investing in any Meme coins, a comprehensive research study is a must.

Initial Coin Offering (ICO)

A cryptocurrency-based ICO is similar to an IPO on the stock exchange. Developers raise capital by providing a portion of the coin's total supply.

Ethereum is a great example of this. Within the first 12 hours, it could raise $2.3 million. Investing in ICOs allows financiers to get a great deal on the upcoming tokens and buy them early.

ICO buyers should be cautious as the person establishing the token may do a "carpet pull" and harm investors financially.

Allotment of the Crypto Portfolio

Follow an allocation strategy that works best for your situation when choosing your crypto portfolio allocations. You can use a variety of methods to accomplish this. Dollar-cost-averaging is one of the most widely known approaches. By purchasing tokens at regular intervals regardless of their rate, this strategy reduces any volatility of a token.

The value of your portfolio is directly affected by your ability to handle threats. You should invest in more stable tokens if you want to keep your finances safe. You should allocate at least 50% of your portfolio to stable cryptos such as Bitcoin and Ethereum, regardless of which side you choose.

Invest at least 35% in the most successful altcoins, such as Lucky Block and Defi Coin.

The remaining quantity can be assigned in two ways. In case you don't like the risks associated with crypto, allocate the remaining amount as USD coins. For those who don't mind the risk, high-risk coins such as Dogecoin or SHIBA can be an excellent choice. The values specified here alter according to the requirements and likes of the portfolio owner. This is just an easy introduction to a crypto portfolio.

Crypto portfolio-building ideas

Diversity

Diversity of the coins in your portfolio is something that you ought to do after extensive research study on the marketplace. A lot of crypto investors tend to buy coins that are stable and share a big part of the market.

As of 2022, the best coins to consist of in your crypto portfolio are,

-

Bitcoin

-

Ethereum

-

Cardano

-

Solana

-

Avalance

-

Near

-

Algorand

Buying more established coins will assist to ensure the liquidity of your crypto portfolio and more financial stability.

Portfolio tracking

Cryptocurrency trackers are a kind of tool that helps to track any movement of the possessions hung on your crypto portfolio. These will assist to track your current allotments and identify whether they line up with your financial objectives or not. Applications like CoinStats are a great method to link to your exchanges or wallet to keep an eye on the token efficiencies, so determining crypto taxes becomes much easier.

Allocation portions

Depending on the portfolio owner's choices, allowance quantities and values differ. It is the owner's attitude towards danger that changes the percentages the most. Investors who prefer big risks and high returns tend to invest more in unstable coins, while those who are risk-averse tend to invest more in steady tokens like Bitcoin.

Conclusion

The best way to navigate the crypto environment is to maintain a well-crafted and diverse portfolio. In order to choose what to include in your portfolio, you should conduct research. Take your time when making the portfolio and do the necessary research. Then you will be able to choose which coins are right for you at what portions.

.jpg)

.jpg)